Union budget 2023 : After a Friday sell-off in the stock market, it hit a four-month low on Jan. 27, the first day of the new monthly series. Because of this, the largest weekly decline was recorded on December 23 last year. Union Budget 2023 launches next week (Budget 2023) and traders remained cautious in the market due to the outcome of the FOMC meeting.

Last week BSE Sensex (BSE Sensex) fell 1,291 points, or 2.13 percent, to 59,331 and the Nifty 50 (Nifty50) fell 423 points, or 2.35 percent, to close at 17,604. However, the fall in the mid-cap and small-cap indices was larger. Over the week, big losses in banking & financial services, energy, metals and infrastructure stocks put pressure on stocks. On the other hand, buying has been observed in auto, FMCG and technology stocks.

Ajit Mishra, VP (Technical Research), Religare Broking said: “The market is showing signs of further headwinds. The market can also experience volatility due to events such as the Union Budget and the Federal Reserve Board meeting. He further said that more attention should be paid to risk management.

The market will be keeping an eye on these 10 factors next week.

Union Budget 2023

Union budget 2023: union budget It will be of great importance not only for the financial markets but also for the economy. Because of his policy announcements, the progress of many sectors will be decided.

Varun Lohchab, head of HDFC Securities (Institutional Research), said: “The government is likely to increase capital spending on the sector by 20 to 25 percent, with a focus on the country’s supply-side infrastructure. This is the government’s last budget before the next general election, so allocations for food subsidies, employment guarantees and rural infrastructure can be increased. In addition, policies to increase consumption can place a significant focus on rural India.

FOMC session

FOMC meeting : The results of the two-day meeting on January 31st and February 1st will be very important for the market. More hawkish comments from Fed officials recently, prioritizing inflation, are expected to result in another 25 basis point hike in the Fed rate to a range of 4.50 to 4.75 percent in February.

Apart from that, Bank of England (BoE) and European Central Bank (ECB) interest rates are closely watched by investors.

Budget 2023 Expectations LIVE Updates: CPSEs will be privatized in the next fiscal year, there will be more focus on taxpayers in the budget

global economic data points

Next week these global economic data points may influence the market:

corporate profits

More than 600 companies can publish their quarterly results next week. These include State Bank of India, Larsen & Toubro, ITC, HDFC, Bajaj Finserv, BPCL, GAIL, Tech Mahindra, ACC, Coal India, Indian Oil Corporation, Power Grid Corporation, Sun Pharma, UPL, Britannia, Titan Company and Divi’s Lab .. huh.

car sale

Car sales: Monthly sales figures for car sales will be announced on February 1st. Therefore, Tata Motors, Maruti Suzuki, TVS Motor, Bajaj Auto, Ashok Leyland, Eicher Motors, Escorts, Hero All Auto stocks including Hero MotoCorp and Mahindra & Mahindra are in focus.

In its Jan. 27 report, Emkay said passenger traffic is expected to improve on the back of a strong backlog and increased production.

Budget 2023: Government focus will be on modernizing the armed forces, the effects of tensions will be seen on the Chinese border

Domestic economic data points

Fiscal deficit and infrastructure performance figures will be released on January 31st. At the same time, on February 1st, the S&P Global Manufacturing PMI data for January will be released.

S&P Global Services January PMI and FX Reserves data for the week ended January 27th will be released on February 3rd.

FII investment

Market sentiment remained weak on continued selling by foreign institutional investors (FIIs). Experts believe FII flows will remain volatile as long as the Federal Reserve’s tightening policy lasts.

FIIs sold shares totaling Rs 9,300 crore last week. Only Rs 5,977.86 crore was sold on Friday, which was the highest single day sale since April 18, 2022.

technical view

Technical View: Nifty50 broke the key support zone last month and fell below the 17,800 level. The formation of a long bearish candle on the weekly chart indicates weak sentiment.

Rohan Shah, Head (Technical Analyst) at Stoxbox said, “After the past week of heavy selling, all eyes are on 200 DEMA which is the only silver lining for the bulls.” A strong support zone is seen at 17470-17420.

F&O Signals and India Wix

According to monthly options data, there is maximum open call interest at 18,000 strike prices, which could act as the next key resistance area for Nifty50. After that, resistance will be found at 18,500.

For puts, the highest OI is 18,000 strikes, followed by 17,500 and 17,000 strikes.

From the above data, the psychological level of 18,000 can be important for the market.

The India VIX, considered the index of fear in the market, rose 25.60 percent over the week to 17.32 from 13.79 the previous week.

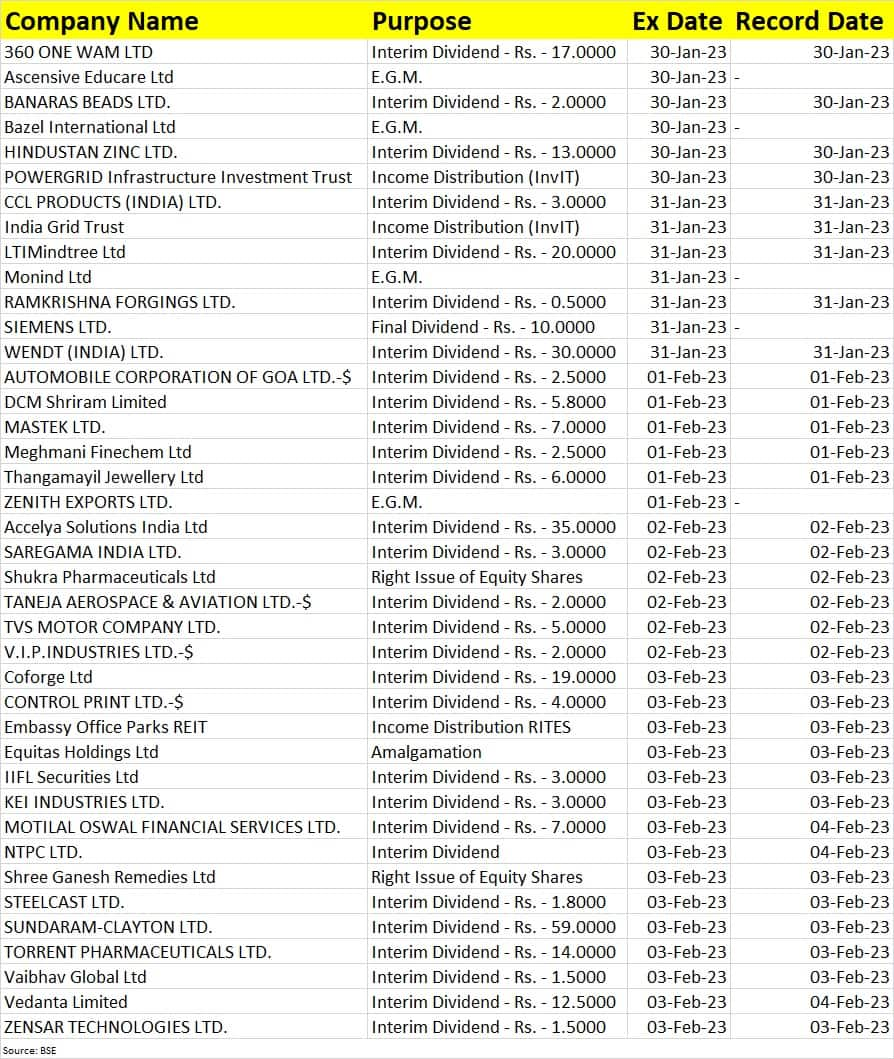

corporate action

Ex-dividend trading will begin in more than 30 stocks next week. These include 360 ONE WAM (formerly IIFL Wealth), Hindustan Zinc, LTIMindtree, Siemens, Mastek, Saregama India, TVS Motor, Coforge, NTPC, Sundaram-Clayton, Torrent Pharma and Vedanta.

Here are the key corporate actions for the next week:

Disclaimer: The views and investment recommendations expressed herein are the personal views and opinions of investment professionals. Moneycontrol advises users to consult certified experts before making investment decisions.